A very low-cost index is going to beat a majority of the amateur-managed money or professionally-managed money. — Warren Buffett.

A very low-cost index is going to beat a majority of the amateur-managed money or professionally-managed money. — Warren Buffett.

Have you bought into the notion that only professional money managers know how to build wealth for you? Are you stoic enough to see your hard-earned money not growing even at a modest 6%? Have you banished the dream of comfortable retirement? You are not alone!

The hallmark of street smart approach to life — and even to investing — is to defy pervasive myths so that you can take control of your own destiny. In fact, you can beat professional money managers without spending more than 20 minutes of your time per year. All you need is to understand time-tested Gone Fishin’ Portfolio developed by Alexander Green.

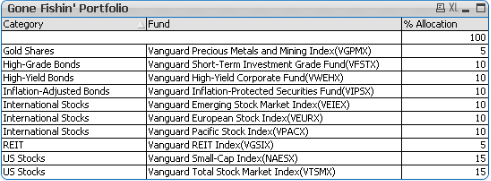

Gone Fishin’ portfolio proves the wisdom of Oracle of Omaha very well by investing entirely into low-cost, well diversified Vanguard Index funds. After a friend of mine advised me to read this amazingly simple yet profound book of investing, I felt compelled to share this simple yet powerful wealth building portfolio.

If you have never heard of Vanguard funds, I recommend that you first dive deep into Jim Collins’s blog to know why he vehemently believes in Vanguard family of funds to build wealth for the long haul.

The cornerstone philosophy of the Gone Fishin’ Portfolio is to invest in well diversified Vanguard index funds in your tax deferred accounts to build wealth. This portfolio has a spectacular 15+% return since its launch in 2003.

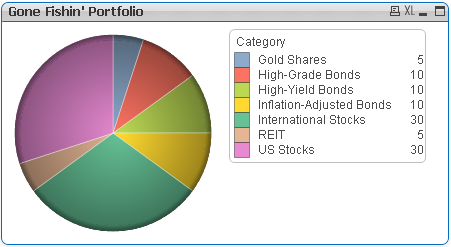

Asset Allocation

Alexander Green believes that asset allocation alone plays a vital role in your portfolio’s long-term performance. He has developed his asset allocation model based on Harry Markowitz’s research paper “Portfolio selection,” published in the Journal of Finance. In 1990, Harry Markowitz won Nobel prize in economics for his groundbreaking research.

Alexander Green believes that asset allocation alone plays a vital role in your portfolio’s long-term performance. He has developed his asset allocation model based on Harry Markowitz’s research paper “Portfolio selection,” published in the Journal of Finance. In 1990, Harry Markowitz won Nobel prize in economics for his groundbreaking research.

In a nutshell, theory espoused by Harry Markowitz underlines the fact that it is impossible to remove uncertainty from the markets, but you can mitigate long-term risk inherent in the market by devising a portfolio of uncorrelated assets like stocks, bonds and precious metals.

Importance of Rebalancing

Once you design a portfolio of uncorrelated assets, your investment is on auto-pilot. Depending on the superior performance of certain asset class, you will end up having your portfolio with different percentage weighing by each asset at the end of the year. It’s time to rebalance your portfolio. It’s wise to rebalance only after a year to avoid short-term capital gain(currently at 15%, and possibly 30% next year unless Washington can make any progress on the fiscal cliff).

Akin to smooth ride you get after balancing all four wheels of your car, your balanced portfolio allows you to invest more in the under-performing assets and, at the same time, reduces overall risk in the long haul.

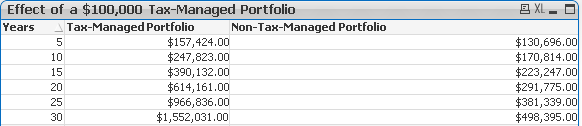

Remember the Taxman

Average mutual fund takes 2.5% in annual cost each year. Taxes take another 2%, on average. — John Bogle

If you follow Gone fishin’ portfolio strategy and invest entirely in Vanguard funds, you will end up saving 2% each year in annual cost alone. But, don’t rest on your laurels yet. The taxman is about to become your silent partner, if you don’t think about ways to avoid paying taxes on your growing portfolio. The best way to find tax shelter is to invest all your money into tax-deferred account. By doing so you boost your portfolio performance by 4.5%.

Avoiding taxes on your portfolio is not an abdication of your civic duty; rather, it is to secure your retirement as evident from the stark performance difference between tax-managed and non-tax-managed portfolio.

Avoiding taxes on your portfolio is not an abdication of your civic duty; rather, it is to secure your retirement as evident from the stark performance difference between tax-managed and non-tax-managed portfolio.

Parting Thought:

Gone fishin’ portfolio is one of the simplest strategies you can use to grow your long-term portfolio at a double digit rate without dealing with anxiety to invest in individual stock. This New York Best seller proves that you don’t need to hire a pro to become wealthy; rather, you need to thank John Bogle.

Most individual investors would be better off in an index mutual fund. — Peter Lynch

Elsewhere:

The Market Always Goes Up @ Jlcollinsnh

Can’t Save? Write it Out, Bitches @ Free Financial Advisor

Easy Tips for a Richer Life @ Modest Money

Sounds intriguing Shilpan. Simple and low cost certainly appeal to me! And do I understand correctly that this portfolio has returned over 15% per year, on average, since 2003?

John Bogle’s one of my investing heroes, and Vanguard surely transformed the mutual fund business. I’ll have to put Gone Fishin’ on my reading list.

Thanks!

That’s right, Kurt!

http://www.gonefishinportfolio.com/asset-allocation.html

In the seven years since its inception, it has done just that, returning 15.5% a year while experiencing less volatility than the S&P 500.

I do not agree with the idea of investing in broad based index funds. Like the standard and poor five hundred. Theirs many narrow sector funds available that are indexes to themself. Why not buy into these sectors when they have declined by a hugh amount. A good example is solar exchange traded funds these funds have declined close to 95% from their highs of five years ago. Theirs also many single country funds that are available today that were not available just a few years ago. When theirs some kind of financial crisis in another country that could create a great chance to buy that countries stock market at a great price.

Thank you, Sir!

I’m honored you chose to link to my site.

While the Fishin’ portfolio would certainly work and its use of Vanguard Index Funds is laudable, it is needlessly complex. 🙂

I think you have uncanny ability to simplify, so I would like to know your thoughts about making Gone Fishin’ portfolio simplification.

Thanks Shilpan…

Kind of you to ask. Where Fishin’ uses 10 funds, I use 3, all Vanguard as well:

http://jlcollinsnh.wordpress.com/2012/05/12/stocks-part-vi-portfolio-ideas-to-build-and-keep-your-wealth/

Basically what Fishin’ has created is an allocation to address three goals:

60% Growth, Using Two USA Stock Funds (30%) and three (!) International funds (30%).

20% Deflation protection: Two Bond Funds

20% Inflation protection: The Gold and REIT funds and the inflation adjusted bond fund.

My Smoother Path Portfolio does the same but less expensively and more simply:

50% Growth with VTSAX, Total Stock Market Index Fund.

25% Inflation Protection with Real Estate in VGSLX (Vanguard Total REIT Index Fund)

25% Deflation Protection with VBTLX (Vanguard Total Bond Market Index Fund) + whatever cash I happen to be holding at the time.

These three also have the advantage of being even less expensive than the Fishin’ funds.

Note, I don’t feel the need for International Funds for reasons explained here: http://jlcollinsnh.wordpress.com/2012/09/26/stocks-part-xi-international-funds-2/

I am also not a fan of gold, but I’ve yet to write that post. 🙂 For now let’s just say REITS perform that role with the advantage of throwing off income along the way.

Hope that helps!

Thank you, my friend. I am sure that readers will benefit handsomely from your wisdom.

Sounds pretty solid Shilpan! I’ll have to compare this list to the one I put together myself this past month. I do love the goal of security and steady returns.

You are very good with numbers, so I appreciate if you can share your analysis here, MMD!

Quick reminder; When interest rates rise, the value of the bond funds will drop. But all in all, 15% since 2003 is quite impressive.

Agreed. Value of bond fund has inverse relationship with the rate of interest. Thanks for the reminder, Barb!

[…] on Stocks — Part XV: Target…Shilpan on Stocks — Part XV: Target…Gone Fishin’ P… on Stocks — Part II: The Ma…Gone Fishin’ P… on […]

I enjoyed reading your take on the fishin’ approach. I love Vanguard funds, but only have four instead of ten. Easy is often better for amateurs such as myself. Have a great Holiday season.

[…] @ Street Smart Finance takes on a review of the Gone Fishin’ Portfolio. A simple way to build a portfolio through low-cost index investing, preferably with Vanguard. In […]

[…] there's ample proof that this concern is not true and never has been. Read more on MarketWatch Facebook's first report: Numbers, or chatter? Markets Stream gives you a single place to follow…social networks. Here … Read more on MarketWatch U.S. economy moving sideways again WASHINGTON […]

[…] you are looking for a more simplified way to invest, check out the Gone Fishin’ Portfolio at Street Smart […]

[…] Gone Fishin’ Portfolio: A Simple Way to Build Wealth on Street Smart Finance […]

[…] Gone Fishin’ Portfolio: A Simple Way to Build Wealth […]

If your objective is to perform in line with the market than an index fund is fine.

[…] putting all of your eggs in one basket is a surefire way to bring misery. That’s why I like Gone fishin’ portfolio as it makes investing as simple as you can […]