Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down. — Warren Buffett

There is no doubt that both value and growth investing styles have their share of staunch followers.

Those who believe in Graham and Warren Buffett’s value investment style believe that growth investing is for roulette players. On the other hand, growth investors believe that value investing is a thing of the past with mediocre return at best for the serious investors.

Wouldn’t it be nice if you can find the best investment strategy that combines best of value and growth strategies?

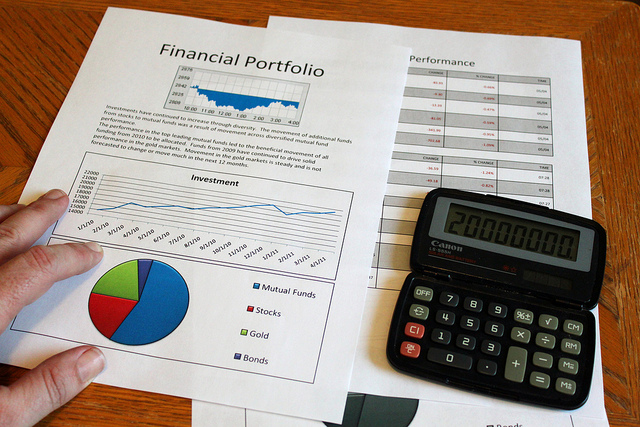

As paradoxical it sounds, you can create your own fund to invest for growth and dividend income. You can devise your own asset allocation strategy to invest in growth stocks with consistent dividend income, an inflation resistant index fund, and precious metals such as gold and silver.

Let’s assume that you have $50,000 to invest. What would be your best investment strategy to generate income while growing your portfolio faster than what you can expect by investing in value stocks?

Let’s assume that you have $50,000 to invest. What would be your best investment strategy to generate income while growing your portfolio faster than what you can expect by investing in value stocks?

The key is to find Large Cap Value stocks with consistent growth potential for long time.

As you can see in the chart, $100 invested in the Large Value stocks would have become close to cool one million dollars between 1928 and 2000.

Depending on your age and capacity to take risk, the best investment strategy would be to allocate up to 40% in Large cap value stocks with consistent dividend history and incredible competitive advantage, 30% in the Vanguard Index funds, and the rest in the precious metals.

There are many great large cap value stocks with consistent growth and dividend income to choose from.

1. Apple

I am a die-hard Apple fan. With that said, Apple is probably the best large cap stock with incredible growth potential in the current market. Apple holds largest market capitalization ever!

I’ve written several articles to articulate why I like Apple. I consistently invest in Apple stock when market beats it down. For the last three years, I have snatched Apple shares when it fell for more than 10% from its current high. Why?

Not only Apple pays $10.6 per share just in dividend a year, it will also repurchase $10 billion worth of shares from the market. Not bad for the stock that has gone from $7.37 on August 1, 2002 to over $665 in 2012. Your $7K investment would have been worth around $665,000 in just 10 years.

With amazing products such as iPhone5 and Apple TV in its war chest, and forward P/E of less than 10 for a company that’s growing both the top line revenue and EPS like a small growth company, you have best of both worlds with Apple stock.

2. Johnson & Johnson

There aren’t many pharmaceutical companies in the world with the kind of competitive advantage JNJ has. The maker of band-aid also has over 90% market share in the surgical sutures and needles used by hospitals around the globe.

For almost 50 years, JNJ has consistently increased dividend at an average 7% per year. If you include the fact that stock has gone up $39.54 to $68 in 10 years, you’ve found an investment generating over 15% return for the past lost decade.

3. IBM

Big blue has transformed itself into a technology behemoth that grows its dividend at 17% annually for the last decade. With its increasing cash flow due to focus on the consulting and software services business, IBM is projected to increase its dividend at 21% in the next decade.

Add to that the fact that its share price has gone up from $59.26 to almost $200 in a decade, you’ve a solid investment generating more than 20% annually for the lost decade.

How about Gold and Silver?

What’s the best time to invest in gold and silver? With the jitters in the global markets, now is the best time to allocate portion of your investment into precious metal.

Whilst it might be a good time to invest 10-20% of your money in gold via sites such as bullionvault, for example, it’s safer to stay away from speculative investment like buying currency within the forex market. Gold and Silver ought to act as hedge against market uncertainty and asset protection.

Index Funds

My pal Jim has written an amazing article about VTSAX(Vanguard Total Market Index Fund), so I can’t do a better job of dwelling into it. But, I have found another gem lately for those who seek lower expense ratio and better return on their investment.

As most of us are not good at knowing when to invest in a bond fund, Vanguard offers inflation-protected securities fund for those who want to invest in bonds without knowing how to.

This fund has doubled in value in the past 10 years with an annual return of over 8% per year. Although I have not invested in this fund yet, I am going to do so in the near future.

The best investment strategy is to protect your investment first, and find ways to generate better return than the so-called market experts.

While it seems like a difficult feat to achieve, you can beat the market if you do your own research and invest with a street smart approach without allowing others to influence your investment decisions.

Rule No.1 is never lose money. Rule No.2 is never forget rule number one. — Warren Buffett

Readers: Have you thought about the best investment strategy to generate both income and growth?

Elsewhere:

Cut Your Losses Mark Cuban @ Buck Inspire

Thoughts About Investing @ Modest Money

What Phase of Investing Are You In? @ Work Save Live

Asset Allocation Models @ My Money Design

Photo by: rhome_music; Chart photo by: gummy-stuff.org

Sounds like some great stocks to pick and a solid overall plan. I am just starting to get into more serious investing though. So I still have to do a ton of research before I make the move from the mutual fund I currently have.

I don’t blame you. Investing takes lots of thinking and prudent planning. It’s better to be safe than sorry.

Great topic and execution! I’m glad you included TIPS here. I rarely see bloggers mention them, and it’s a fine oft-overlooked asset class.

I can’t agree with you more, Joe! Your portfolio should have some risk hedging asset class.

Great tips! I’m glad you mentioned gold and silver as a way to hedge market uncertainty. I think some people just invest in them because everyone else is–following the herd.

The companies you mentioned are diversified among their business lines. And Vanguard is solid..so there’s no need to rehash the same story, eh?

I really enjoyed reading this.

Thank you, Ornella! The idea is to generate above average market returns with asset protection.

Shilpan, I like to hear you talk about investing! Great work my friend.

I’m always scared of the single stocks, but I definitely understand where you’re coming from. I’m just not sure I’d own Apple right now. The only place they have to go is down.

Jason, Apple is still most undervalued stock. Look at its sales and earning per share growth and cash on hand. If you take over $100 per share in cash, this stock is trading at less than 10 times next year’s projected revenue.

Good article. I am bullish on equities. I don’t believe that investors best move is using index and mutual funds. Some will say that it is safer but I think that reasoning is overblown.

My largest holding is AAPL. They have huge growth potential yet, which is amazing for such a large cap stock. I like to value a stock like AAPL with PE as well, which is currently reasonable based on historic PE ranges.

What I wonder is if the market will ever reward them with PE expansion.

You are very wise. How can you complain about company that enjoys incredible competitive advantage in a commodity like business. Apple is executing flawlessly, and as long as its management does an excellent job, investors will push the stock price higher.

Thanks for the well-thought out plan. I am not doing much investing right now, but once I get my income up, I am looking at a plan to get the most out of my invested dollars. Thanks for the education 🙂

Thanks for the kind words, Jacob!

Agree! Reading great articles like this helps me get more prepared for the future when I’m able to invest.

Thank you. Like anything else in life, investing also takes lots of preparation. With the advent of the Internet, you can master the art of investing without handing your hard earned money to so-called experts, i.e. mutual fund managers.

Great picks and reasons why they make good investments! Still kicking myself with Apple. Mark Cuban ate a few hundred thousand dollar loss, but the damage would be way worse if he had held on till now. Thanks for including me!

Lots of people don’t know, but even Warren Buffett says that you’ve to cut your losses if you make mistake. I like Cuban’s business acumen.

Thanks for the tips. I really need to shift some of my IRA into something other than stocks, but never know when to do this. Do you think the inflation protected Vanguard fund is a good way to do this? What percentage would you suggest for someone who is 38 with super high risk tolerance?

Vanguard inflation-protected securities fund is a much safer investment. If you visit their site, you will see that since this fund invests in government bonds, it is lot safer than a stock fund. I think every portfolio should have some divided paying high quality large cap stocks, some index funds and some bond funds. I normally like investing no more than 10-15% in a single instrument. Thank you for visiting, Kim!

“It’s not how many people you shoot, it’s who you shoot.” Harlem Nights – Eddie Murphy

High quality dividend growth stock is the way to go to build LONG TERM wealth.

For average people it is better to invest in high quality NON-CYCLICAL stocks like KO, PG, JNJ, MCD, PM. High quality mean repetitive brand. Brand is already established and who ever manage the company only need to keep it’s standard. Non cyclical mean economic cycle will not impact on their business and earning in any meaningful way. It will continue to grow more or less in any economic time. This will keep the stock price to drop less in bad time and it will appreciate more over long time including dividend than your average index. Since it drop less in down cycle and still pay dividend individual investor get more faith to keep its position and not sold out at bottom.

High Quality CYCLICAL Dividend paying stocks mean economic cycle will impact its business and earning. When economic cycle is up stock will pay better dividend and price will appreciate much much more than your non cyclical business. But when economic cycle is down stock will pay less or cut dividend and price will drop much more than your average index. Hence it will scare average people to sold out at bottom when they see price drop 80% from top with dividend cut or gone. So you have to know when to buy (at bottom of economic cycle, 2009) and when to sell (at top of economic cycle, 2013/2014??) to make big fortune in cyclical stock. Usually economic cycle runs for 6 to 7 years.

Same with technology stock. You can’t hold them for ever. They out perform market by far when you out innovate your peers. But it is very hard to out innovate your peers all the time hence your stock drop by 90%. Look at NOK, RIMM and don’t forget Apple was in a bad time during 90’s tech boom.

Here is my strategy for long term portfolio. I like to play defense with my NON-CYCLICAL stocks like KO, PG, JNJ, MCD, PM and I like to Play offence with Financial and Energy. You need both to grow economy or business; credit and oil. So I like to add fuel with JPM, WFC, EPD, KMP, PER. Oil will also help you to keep up with higher inflation if that happens.

Now there is nothing wrong with picking up Caterpillar in the middle of economic cycle to boost gain but that should be only for a trade. There is also nothing wrong with picking up un loved NOK when it drops to $1.60 to boost your yearly gain with a trade when those shorts are cashing the register.

With this shared knowledge I leave you alone to decide what you want, what strategy you want to use to build your long term portfolio.

Note: This is not a recommendation. Perform your own due diligence. Presentation of information does not necessarily constitute a recommendation to buy or sell. Never make any investment without conducting your own research and reading multiple points of view.

Well said AJ! You still have to do your home work and stay with the company as long as they execute well.

Thank you for submitting this post to the Carnival of Investing, which is now up:

http://www.investeem.com/2012/08/carnival-of-investing-0.html

Thank you for hosting the carnival, and for the mention!

We are still working on building our portfolio and right now we do index funds to diversify as much as we can. Once we have a bit more built up than we may invest in a few individual stocks. I have wanted to buy Apple and Google for a long time. Once I do our portfolio will grow even more.

I think you’ve made a wise decision to start with an Index fund.

[…] The Best Investment Strategy for Growth and Income Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down. — Warren Buffett There is no doubt that both value and growth investing styles have their share of staunch followers. Those who believe in Graham and… Read more […]

[…] The Best Investment Strategy for Growth and Income on Street Smart Finance […]

[…] Shilpan @ Street Smart Finance writes The Best Investment Strategy for Growth and Income […]

[…] @ Street Smart Finance writes The Best Investment Strategy for Growth and Income – There is no doubt that both value and growth investing styles have their share of staunch […]

[…] The Best Investment Strategy for Growth and Income Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down. — Warren Buffett There is no doubt that both value and growth investing styles have their share of staunch followers. Those who believe in Graham and… Read more […]

[…] The Best Investment Strategy for Growth and Income Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down. — Warren Buffett There is no doubt that both value and growth investing styles have their share of staunch followers. Those who believe in Graham and… Read more […]

[…] The Best Investment Strategy for Growth and Income Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down. — Warren Buffett There is no doubt that both value and growth investing styles have their share of staunch followers. Those who believe in Graham and… Read more […]

Good idea to have 10% or so in gold. Not so sure about Apple for the long term, though.

[…] The Best Investment Strategy for Growth and Income by Street Smart Finance. […]

Oh it sounds so very simple buy shares in good quality companies. The problem is a very good company today might be a very bad company in 10 years. Or the reverse might be true a very bad company today might be a very good company in 10 years. Few investors are aware that apple traded at just 5 dollars a share in 1998 today apple shares trade at 450 and just less than a year ago the shares of apple traded at 750 dollars a share. Hows that for a long term record.