Have you heard the age-old adage, “Put your money where your mouth is”? This wisdom teaches you the best way to invest money if you are a food lover.

Have you heard the age-old adage, “Put your money where your mouth is”? This wisdom teaches you the best way to invest money if you are a food lover.

Imagine that you can get free food from yummy restaurants that you can’t wait to visit every weekend — I am not kidding!

Here’s the scoop — the best way to invest money if you are food lover is to find Restaurant Chains that are growing rapidly in your city and elsewhere in this country or wherever you live on this planet. Then invest small amount to buy stock of these yummy places that people are flocking in.

The best way to invest money for food lovers is to find a publicly traded Restaurant Chain that — has earnings per share growth of 25% or more for the past three years; has no debt; and, offers food that everyone craves for.

I have selected three Restaurant Chains that fit your bill.

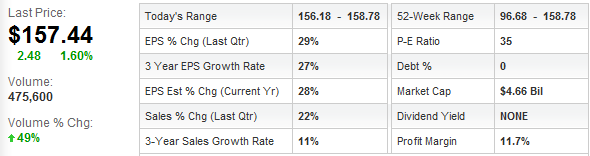

1. Panera Bread(PNRA)

Panera Bread Company owns and franchises 1,504 bakery-cafes as of September 27, 2011 under the Panera Bread®, Saint Louis Bread Co.®, and Paradise Bakery & Café® names. Panera Bread bakery-cafes are principally located in suburban, strip mall, and regional mall locations.

Panera Bread offers high quality, reasonably priced food in a warm, inviting, and comfortable environment. With their identity rooted in handcrafted, fresh-baked, artisan bread, I love their great tasting, quality food.

Nearly all of their bakery-cafes have a menu highlighted by antibiotic-free chicken, whole grain bread, and select organic and all natural ingredients, with zero grams of artificial trans fat per serving, which provide flavorful, wholesome offerings.

Let’s apply same rules that we’ve discussed earlier to find best of the breed yummy investments!

- Earning per Share: Panera Bread is growing earnings per share(EPS) by average 27% for the last three years.

- Debt: Panera Bread has no debt. Panera Bread delivered 43% cash-on-cash store level Return on Investment (ROI) for the 52 weeks ending June 28, 2011.

- Profit margin: Food business is highly competitive business. So, Panera Bread’s 11.7% profit margin is spectacular for its niche. Its Return on equity is equally impressive 18.8%.

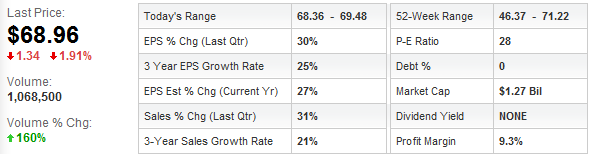

2. Buffalo Wild Wings(BWLD)

Buffalo Wild Wings and Grill is one of the Top 10 fastest-growing Restuarant Chains in America. Their Restaurants also offer a sports bar, featuring everything from salads to appetizers to burgers, and variety of specialty items.

Buffalo Wild Wings and Grill is one of the Top 10 fastest-growing Restuarant Chains in America. Their Restaurants also offer a sports bar, featuring everything from salads to appetizers to burgers, and variety of specialty items.

These restaurants serve food in relaxed, comfortable atmosphere where you can hang out with friends — to play trivia on their Buzztime trivia system or to watch your favorite sport on one of their many big-screen TVs.

- Earning per Share: Buffalo Wild Wings Inc. is growing earnings per share(EPS) by average 25% for the last three years.

- Debt: Buffalo Wild Wings Inc. has no debt. It is growing sales at 21% annually for last three years and has 16.5% Return on Equity.

- Profit margin: Buffalo Wild Wings Inc.’s profit margin is healthy 9.3%; its Return on equity(ROE) is 16.5%.

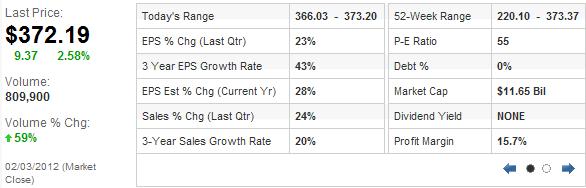

Chipotle mexican grill has seen meteoric rise in the fast food segment. It’s innovative idea of serving high quality, delicious food quickly with an experience that not only exceeded, but redefined the fast food experience. As of April 2011, Chipotle Mexican Grill has opened 1163 locations and it plans to open several hundred more every year for the foreseeable future. With ever-growing demand for its high quality, organic fast food concept, Chipotle Mexican Grill has potential to grow in American and beyond.

- Earning per Share: CMG is growing earnings per share(EPS) by average 43% for the last three years.

- Debt: CMG has no debt. CMG has increased its cash hoard by $409.88 million in last five years.

- Power to dominate: If you eat at Chipotle Grill, you will become a fan. It has created a new market for high quality, healthy fast food.

- Profit margin: CMG has healthy profit margin of 15.7% and equally imressive return on equity of 23.3%.

That’s a good way to invest. Unfortunately, we don’t really eat out much and when we do, we tend to avoid the chain restaurants. 🙂

Chipotle is doing really well.

I agree with you about Chipotle!

Shilpan-

I enjoyed this article. My wife loves Panera and my kids can’t seem to get enough of Chipotle. I never thought to invest in them though. Thanks for bringing it to my attention.

Mark,

We often forget that best way to invest money is to first see what we enjoy most in our everyday life. Peter Lynch used that philosophy for years. So, we can profit from his wisdom. Thanks for stopping by.

We are always told that the best way to enjoy anything is to start with our passions and follow our heart. This is one of those things. Great article and very useful information. love it!